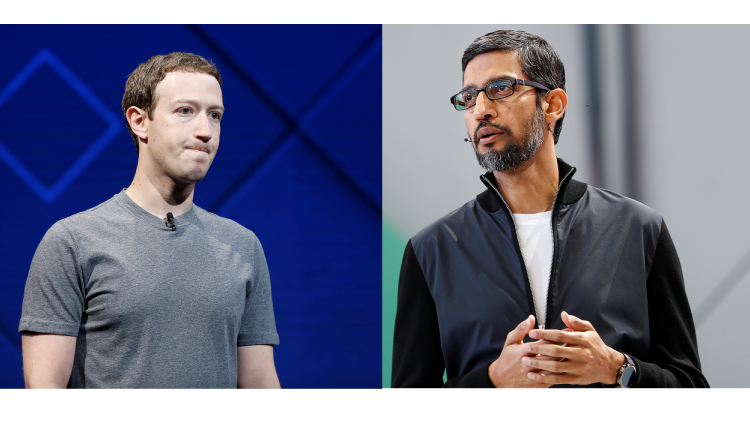

New Delhi: The government is looking to set a revenue threshold of Rs 20 crore and a limit of 500,000 users above which non-resident technology companies such as Google, Facebook and Twitter will have to pay direct taxes on profits earned locally, multiple sources in the know of the matter said.

Multinational tech companies have been accused of paying very little taxes locally despite earning significant revenue and profits from offering services such as online advertising to customers in India. Hence a step may be taken by the govt. to increase the revenue by these multi- national giants.

These limits are part of the ‘Significant Economic Presence’ (SEP) concept that was introduced in the budget last year. The government is also considering that if the SEP could be made a part of the draft Direct Taxes Code, which seeks to consolidate laws relating to direct taxes. The draft is expected to be submitted to the finance ministry soon.

The CBDT had in a notification in July 2018 asked for suggestions to frame rules related to SEP, but the government has not yet finalised it. A sense of urgency, however, has crept in after finance minister Nirmala Sitharaman urged G20 members last month to fix the issue of taxation of profits made by digital companies.

While India is backing the concept of SEP, the EU has indicated that it could levy a tax of 3% on digital revenues generated in the source country.

Organisations like Google and Facebook have started billing users locally, but they do not report the entire transaction value as part of their India revenue. They only report a part of the transaction as commission, while the rest of the money is remitted to overseas entities as cost. Hence India introduced an equalization levy of 6% on such remittances, one of the highest in the world.